Long legged doji

Long legged doji

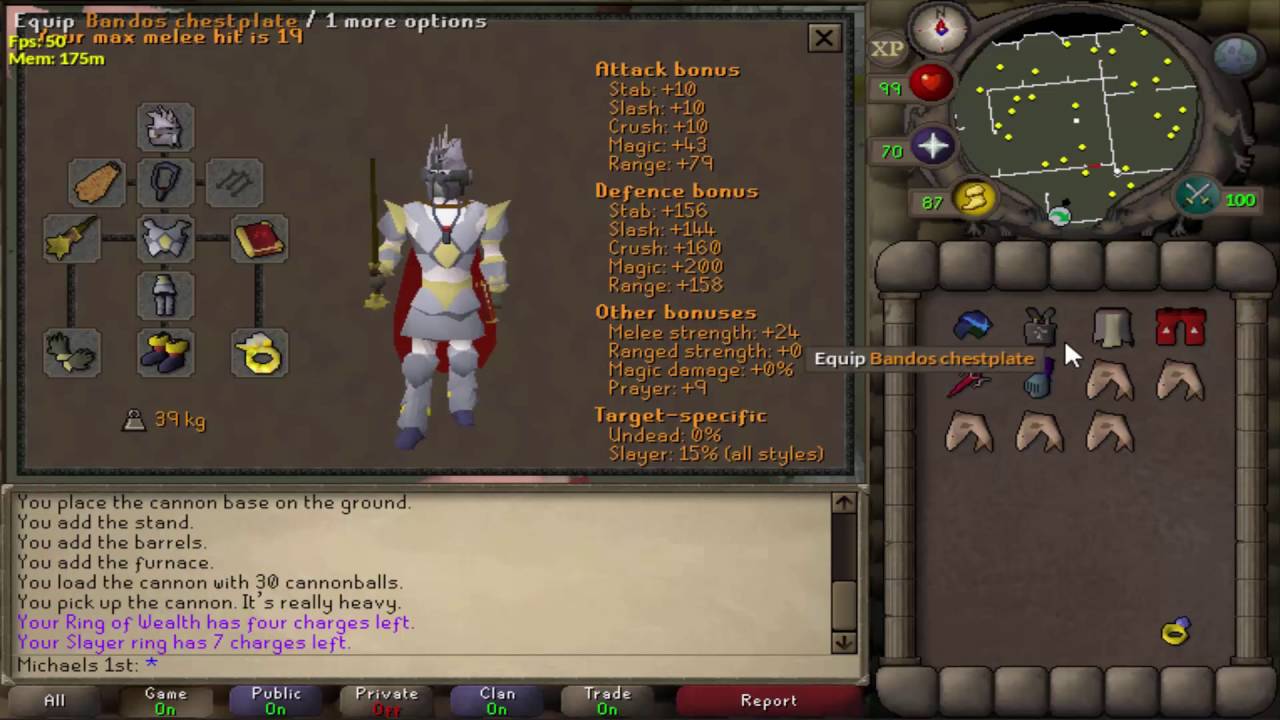

Prix élevé, tableau de valeurs réelles. 2. The two doji candlestick variations above represent uncertainty and could be viewed as good indicators for trade entries. The Southern Doji is a pattern belonging to the group of one-line patterns. Long-Legged Doji. Long-Legged Doji.

It is a very important reversal signal and it signifies a great amount of indecision in the market. Pola semacam ini mirip dengan Spinning tops, dan pola Doji ini juga mencerminkan terjadi banyaknya keputusan para pelaku pasar dalam menjual maupun membeli selama sesi perdagangan berlangsung. It is characterized by being small in length—meaning a small trading range—with an opening and closing price that are virtually equal. A long-legged Doji, often called a "Rickshaw Man" is the same as a Doji, except the upper and lower shadows are much longer than the regular Doji formation. Doji’s are often found at the end of a trend move or during times of consolidation where there is little buying or selling momentum.

– The shadows (Upper and Lower) of a Long Legged A typical long-legged Doji pattern is formed when the opening price is almost equal to the closing price but there was a lot of intraday movement on either side. Gravestone Doji is formed when open and near the bottom end trading range. Long-Legged Doji-You can recognize this formation by one or two long tails (shadows). A Long-Legged Doji has long shadows, meaning there was quite a bit of price movement higher and lower within the time period. Register FREE to see today's results It appears in four different shapes; Long legged Doji, Dragonfly Doji, Gravestone Doji, Four price Doji and Neutral Doji.

This formation indicates that although the market was characterized by strong action between buyers and sellers (who form the Long / Medium Upper and lower shadow), but the market remains closed on the position of indecision, where none of the parties that believe in what's supposed to Rock Sexton 109 posts msg #107157 - Ignore Rock Sexton 7/21/2012 2:03:23 AM It's close . This indicates that, during the timeframe of the candle price action dramatically Gravestone doji candlesticks make up candlestick patterns and tell a price action story. 14% and 2. Long legged doji candlesticks tell the story of indecision. When the open and close are either at the top or the bottom of the range, the pattern is called a long legged Doji.

This formation will sometimes alert that we have reached the top of the market or warn that the trend has lost sense of direction. If you understand that, then ask your significant other for a treat, and tell them Tom sent you. On the other hand, if a full-bodied candle closes above the doji high, enter long at the close of the candle and place a stop 4 pips below the low of the doji. Although Long-legged Doji. patterny.

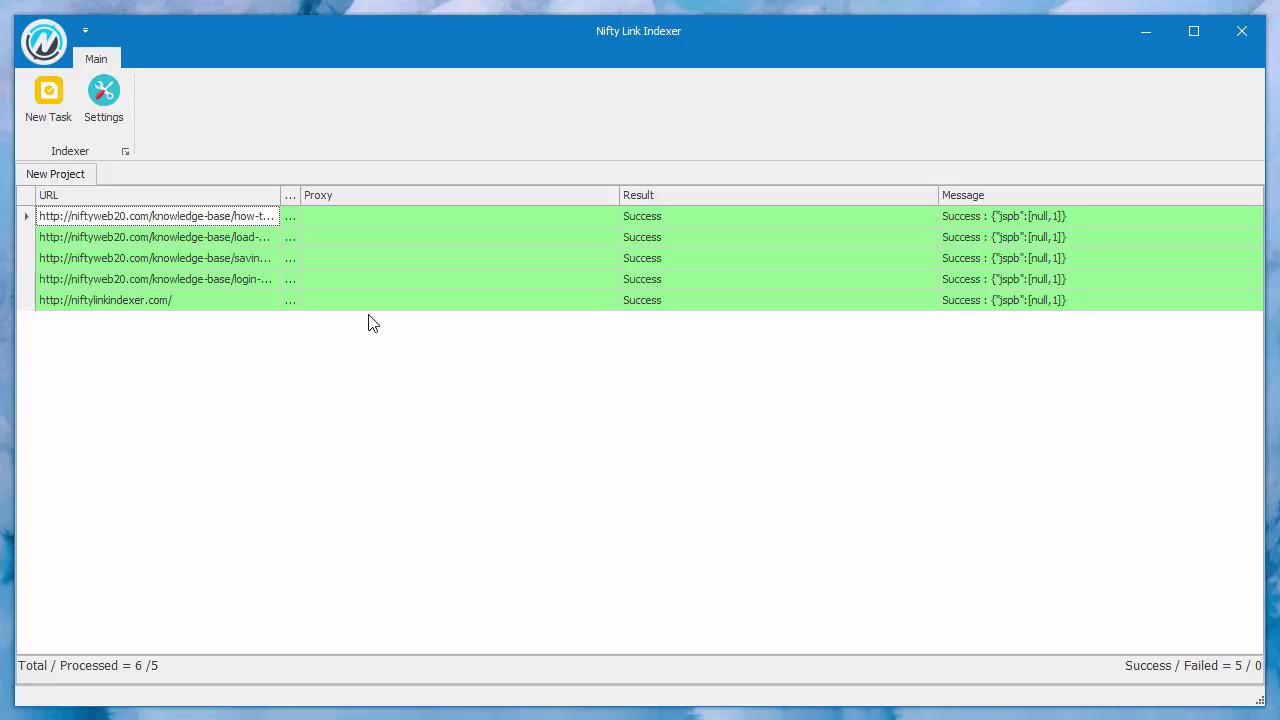

Total symbols:89 Time frame: weekly Occurrence: 2014. Long-legged Doji – This doji line has a long upper and lower shadow with the price in the middle of the range. Na svíčkových grafech se v průběhu obchodování tvoří často opakující svíčkové formace tzv. Gravestone Doji. The Doji bara famine (also, Skull famine) of 1791-92 in the Indian subcontinent was brought on by a major El Niño event lasting from 1789 CE to 1795 CE and producing prolonged droughts.

A Dragonfly Doji has only one shadow, below the body. Liste de paramètres open. Neutral doji candlesticks look like a cross, inverted cross or plus sign. Seiki Shimizu writes that the traders often take positions in the direction designated by the opening of the candle following the Long-Legged Doji (i. Prices are fluctuating in an upward range of $2.

Read More Glossary > Forex > long-legged doji long-legged doji A candlestick chart pattern used by technical analysts to signal indecision and possible reversal in a Trending Market , which is characterized by almost identical open and close prices despite a wide trading range . There are different varieties of doji lines (gravestone, dragonfly, and long-legged doji) depending on where the opening and closing are in relation to the entire range. Indicates strong forces balanced in opposition. The dragonfly doji is very similar to the hammer pattern and the long-legged doji patterns. The Long-Legged Doji This is a variation of the vanilla Doji but its legs (wicks) are longer and usually this type of candle shows a greater amount of indecision.

Long-legged doji indicate that prices traded well above and below the session's opening level, but closed virtually even with the open. A Long-Legged Doji is a long candlestick pattern. Long-Legged Doji and Spinning Top. All dojis are marked by the fact that prices open and close at the same level. The long-legged doji is a candlestick that consists of long upper and lower shadows and has approximately the same opening and closing price.

Register FREE to see today's results Pola long legged doji, merupakan pola yang terbentuk jika mempunyai ekor atas dan bawah yang hampir sama panjang. It ended at 11010 with a minor cut of 0. However, if many dojis are observed in a chart, the appearance of a new doji will not carry too much weight in signaling a reversal. NEW DELHI: The Nifty50 on Monday kissed the 10,600 mark, but failed to hold it and close above the psychological level. We now have quite a large cluster of these indecision doji’s and other candlesticks that so far are only really saying that we have reached a pause in the up trend that began in early September 2010.

Northern doji are doji that appear during a rally. The long-legged Doji shows that the bull and bear battle has intensified. As stated earlier, a standard doji is a neutral pattern, and when used within the context of a larger pattern, is a useful tool in predicting market reversal. Doji Morita (森田童子, Morita Dōji, January 15, 1953 – April 24, 2018) was a Japanese singer-songwriter, from Tokyo. The stock open and close at the middle of the day’s high and low.

Pola doji ini mencerminkan terjadi banyaknya keputusan membeli ataupun menjual yang diambil dalam gerakan sesi trading dalam market. related news. Long legged doji. ) in technical analysis. It is widely accepted that doji candles are neutral.

Long-legged Doji – this Japanese candlestick signal has a long upper and lower shadow that is almost equal in length, however the trader should observe the candle’s close in relation to the midpoint. Long Legged Doji is a trend reversal candlestick pattern, it is Doji with long upper and lower shadows. Long-legged Doji are characterised as having upper and lower shadows that are similar in length, and they indicate a high level of indecision in the market. Basically, they mean that prices moved a long way above and below the opening level, but closed at around the same level as the open. However, it's typically found in a bullish trend that's about to reverse.

FOUR PRICE DOJI: This candlestick is simply a horizontal line that has no upper and lower shadows. 153) suggests selling any longs traders might have. Long-Legged Doji: The long-legged doji consists of extended tails above and below the opening and closing price, signaling the presence of an active market and potential directional move What is a Long Legged Doji? A Candlestick pattern. First, the open and close of the candlestick must be at (or near) the same price level, so that the doji either lacks a body or has a very tiny body. Last week’s NWN closed as a long-legged doji candle on indecision, yet higher on the week and preceded by two solid widespread up candles on rising volume, which is always an encouraging sign.

A long-legged doji has long upper and lower wicks, indicating that prices fluctuated on both sides during the course of the trading period. A close below the Long legged doji. Estimates of an improved demand outlook and a warmer weather forecast are driving natural gas prices higher. The long shadows indicate that the market rallied and sold off significantly during the session but that neither position was held as the market closed where it had opened. The rickshaw man acts as a continuation candlestick 51% of the time.

Candle's opening price is $55. In either scenario the Long-Legged Doji suggests that there will be a reversal about to occur. Long-legged doji is a candle with a long upper and lower shadows and a small real body. The long-legged doji will have the same open and close price. Long Legged Doji Candlestick Analysis .

A doji candlestick looks like a cross, inverted cross or plus sign. This shows the indecision of the buyers and sellers. While tradition and long-legged dojis are reflective of indecision and stalling, কোন Doji Star এর High এবং Low এর মধ্যে পার্থক্য খুব বেশী হয়ে গেলে ঐ Doji Star টিকে Long – Legged Doji বলা হয় । এই Doji কে যদি কোন Downtrend মার্কেটের তলায় দেখতে পাওয়া The Doji candlestick pattern usually looks like a cross, inverted cross or plus sign. The chart shows three long legged doji candlesticks on the daily scale. If Abs (C0 - O0)> = 3 * abs (C1 - O1), long body.

Long-legged doji is made of long upper and lower shades. This pattern forms when supply and demand forces are at Long-Legged Doji. Heck, Steve Nison devotes a whole chapter to it! The reality is that this pattern doesn't tell you a whole lot. Bullish Long Legged Doji: After Down trend when market show a doji with long legged it is the bullish reversal pattern. A trend reversal can be predicted if this Doji candle continues the trend and both shadows of this candle are long.

Doji are a sign of indecision. Prix ouvert, tableau de valeurs réelles. The key difference between the dragonfly doji and the long-legged doji is that the upper shadow is apparent in the long-legged doji. These doji reflect a great amount of indecision in the market. Neutral Doji.

A Doji is formed when the opening price and the closing price are equal. It is also known as the Dragonfly Doji. This candlestick has long upper and lower shadows with the Doji in the middle of the day's trading range, clearly reflecting the indecision of traders. The dodderers are calling the shots in the market. A long-legged doji is a far more dramatic candle.

Technical stock screener for Doji results. The best average move it can muster is just 4. A long legged Doji candlestick forms when the stocks open and close prices remain the same. A doji or any other candle pattern confirms existing support or resistance. It is important, however, to emphasize that we can consider this candle as a doji, only because we allow small doji body (up to 3% of the overall candle height).

The Long Legged Doji is observed when prices trade well above and below the day’s opening price but then close either exactly at or almost at the same level as the opening price. They are also components of candlestick patterns. Crude oil prices have been fluctuating between $58 and $61 per hi all the long-legged doji is composed of long upper and lower shadows. The long upper and lower shadow is a sign that the market is confused and approaching a transition period. A long legged-Doji can be found when the price of a certain asset opens at a level, trades in a considerable trading range only to close at the same level as it opened.

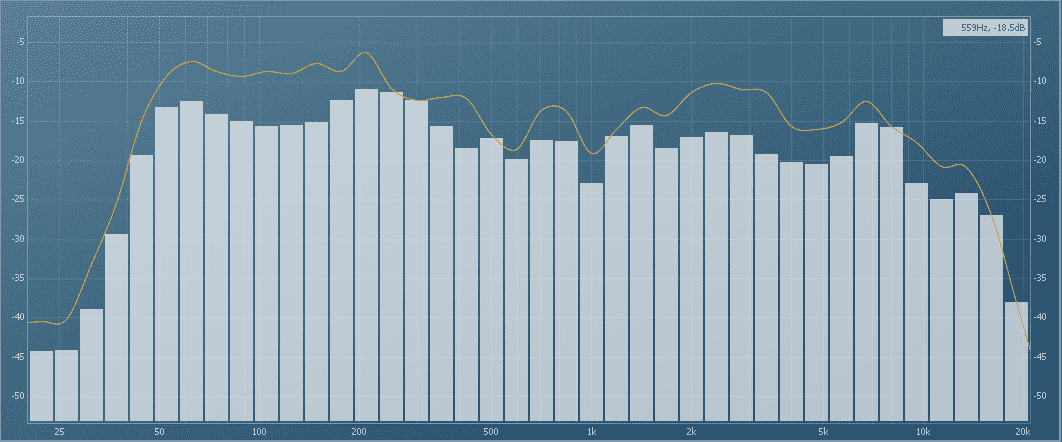

80–$3 per MMBtu (British thermal units in millions). 4. Tech view: Nifty50 forms ‘Long-legged Doji’ pattern; 8,275 level key for bulls The pattern suggests uncertainty, and analysts said traders should wait for a breakout above the 8,275 level before creating any fresh long positions. most of the results show the upper wick and lower wick being almost equal. 1.

The story inside the candlestick : one side showed clear strength, taking price decisively their way but soon after, lost interest or ran out of steam, allowing the other side to win GBPUSD Cable holds slight positive tone in early Friday’s trading after larger bears showed indecision, as Thursday’s action ended in long-legged Doji The second doji being a Long-Legged-Doji basic candle occurs within a Bullish Doji Star pattern. Long legged doji in technical analysis refers to price actions that reveals a strong battle between the "bulls" and the "bears" like dragging the price with a strong resistance all the way to a higher level and eventually lost control to the opposing force because of heavy resistance. Dragon Fly Doji The latest Tweets from Long Legged Doji (@lamesajoker). What happens is the price of a stock either rises during an uptrend and levels out or vice versa levels out after a downtrend. 2, this doji has long upper and lower shadows, clearly reflect- Source The Doji is a candlestick pattern that can be used to find the tops and bottoms of a given trade in a financial market.

A doji with long upper and lower shadows is called a Rickshaw Man or a Long-Legged Doji. Long legged-Doji become more useful to the trader when this type of There are four types of doji candlesticks-- common, long-legged, dragonfly and gravestone. If a Long Legged Doji occurs during a strong Uptrend or Downtrend, it can mean a possible reversal of the current Trend. In some candlestick books, there are some general rules that I identified can used as a basic guide of qualification method of candlestick body, especially to identify a long candlestick. A Long-Legged Doji occurs when the open and close price from a candle are the same, the high is significantly higher … When you see a long legged doji at an area of support or resistance, you might have a reversal in play.

Long Legged Doji – A Long Legged Doji is a signal of indecision of the Trend and of high volatility; it represents the indecision for the future direction of the Trend. The literature contains many descriptions about doji candles that provide examples of schematic thinking. The pattern shows that there is an indecision between the buyers and the sellers, and that the market is approaching transition period. 50 and body size is 0. For the week, the index gained 0.

It is a bearish reversal The long-legged doji is an especially important doji at tops. Watch our video above to learn about long legged doji's. The creation of the Doji pattern illustrates why the Doji represents such indecision. If you want to find out under which situation, "Long Legged Doji " can perform as a bearish reversal Pattern in real market, not theory, this is a must have reference. Long Entry Rules Enter a buy order if the following indicator or chart pattern gets displayed: If the 2 doji candlestick pattern is spotted on the price chart, and price breaks above a resistance level of the QuickFib.

Pola Long Legged Doji ini merupakan pola yang terbentuk jika sebuah candlestick mempunyai ekor atas dan bawah yang hampir sama panjangnya. 51, closing price $55. This pattern also forms only when demand and supply are at the same level. A doji in a downtrend has much less value than a doji in an uptrend. Star Insides 3,501,269 views Long-Legged Doji Candlestick.

When a long legged doji has the open and close in the middle of the upper and lower shadow, it is referred to as a rickshaw man. Classification of Doji pattern. But when it comes after other candles, it can have very powerful Long Legged Doji is a trend reversal candlestick pattern, it is Doji with long upper and lower shadows. Long Legged Doji. Long legged doji means upper shadow and… Berikut ini adalah contoh candlestick Standard Doji.

A long-legged doji signifies indecision in the market but also denotes very high activity. Eventually, the trading period Types of Doji Candles. The long legged doji is a doji with long upper and lower shadows. 13 Point Candlestick Analysis [Key Learning] Lets take a look at a great Sebelumnya, kita telah membahas Pola Candlestick Bearish Dragonfly Doji. com.

On the TimeToTrade charts, an indicator can be added to detect Long-Legged Doji Candlestick patterns. LongLeggedDoji . The typical long-legged Doji pattern is formed when the opening price is almost equal to the closing price but there was a lot of intraday movement on either side. Brief Explanation: The BLLDP is a Doji portrayed by very long shadows. Doji trade signal.

Long Legged – As you monitor the chart, you may stumble upon the long legged Doji. Long-legged doji indicates indecision about the future direction of the security. more LONG LEGGED DOJI: This candlestick is a Doji with very long shadows. A doji during a flat, neutral trading period has no meaning. The indicator can then be used to execute trades, provide an Email or SMS text message notification when your Candlestick chart patterns have been met or backtest trading strategies.

The stock market is a tug of war between the bulls and the bears. Ideas for the best stocks to buy based on data for Jun 04, 2019. The long-legged doji is an extreme variation of the traditional doji, and represents a more volatile extension in both bullish and bearish directions. Long-Legged Doji can be extremely useful to traders. Candle A appears in the middle of a sideways price trend.

The rules of procedure of long candlestick introduction I conclude as below: 1. Long-legged doji represent a more significant amount of indecision as neither buyers nor sellers take control. The doji is the smallest and simplest of all candlesticks, making it very easy to spot. Long legged doji means upper shadow and… The longer the "legs" (also called wicks or tails) of a Doji are the more the indication that equilibrium has been reached. Long legged doji Technical & Fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc.

A long-legged Doji, often called a “Rickshaw Man” is the same as a Doji, except the upper and lower shadows are much longer than the regular Doji formation. Usually, it is very useful in a 1-day candle, especially if it appears in a very strong trend. The Japanese interpret the candle to mean that the trend has "lost its sense of direction". The candlestick pattern can be classified into four types. {quote} From MM point of view, {image} Btw, IMHO Fractal (multi dimensional repeated pattern) in this case in relation with candle formation to indicate turning point, the shortest 'fractal' is not that 3 bars fractal, but single candlestick 'hammer' , 'reverse hammer', long legged doji or reverse long legged doji, or morning star or evening star.

more The sp500 has once again printed today another indecision candlestick, a long legged doji. Hanging Man A black or a white candlestick that consists of a small body near the high with a little or no upper shadow and a long lower tail. Here’s how it looks like… The Long Legged Doji is similar to the Rickshaw Man pattern. Briefly, Doji is the name of a Japanese candlestick charting pattern that occurs when the open and close of the bar of virtually identical. Another candlestick with only one session that also gains significance from the context with which it appears is the doji session, which has exceptionally long upper and lower shadows.

/cdn.vox-cdn.com/uploads/chorus_image/image/55294499/Fallout4_VATS_730x411.0.png)

If prices close very close to the same level (so that no or a very small real body is visible), then that candle is read as a doji. Long-legged doji pattern. 3. All dojis are marked by the fact that prices opened and closed at the same level. The pattern shows that there is an indecision between the buyers and the sellers, and that the market is Doji Candlestick Pattern Formation.

In the long legged doji, the upper wick is shorter. 1 Long-legged doji NYMEX-traded July WTI (West Texas Intermediate) crude oil futures show the long-legged doji candlestick pattern. Read More Long-legged doji have long upper and lower shadows that are almost equal in length. Price has no direction after the doji appears, just as my tests indicate. There are four major kinds of Doji candlestick patterns Regular Doji, Long Legged Doji, Gravestone Doji and Dragonfly Doji.

When candles of different shapes are arranged in a certain way on the chart, they can Long-legged doji is a candle with long upper and lower shadows and a small real body. Slide show presentation of the 40 patterns Long-Legged Doji Candlestick Alerts. Long-legged Doji The long-legged Doji has a long upper and lower shadows almost of equal length. Prix bas, tableau de valeurs réelles. Těžit, či netěžit? Nové dilema, které se točí kolem kryptoměn.

Even after the doji forms, further upside is required for bullish confirmation. Its basic candle is any doji candle type, except the Four-Price Doji because at least one shadow is required. When the buyers and sellers fail to take a decision in the commodity market, it gives rise to Doji pattern. more UMBRELLA: This candlestick is a type of Doji characterized with no upper shadow but a long lower shadow. 1 ~ 2015.

Jedním z nich je i Doji a její variace Long-legged, Dragonfly a Gravestone. This neutral indicator is rendered "Long Legged Doji" in gray below the candlestick. Long-legged doji candlesticks are one of four types of dojis -- common, long-legged, dragonfly and gravestone. A downtrend is required prior the occurrence of this pattern. Long-legged Doji.

This Indicator works by generating a Sell and/or Buy Trade Signal at the end of the pattern, once the pattern has formed. Basically, what happens is the market moves one way and then falters, and retracts back. 2) Long-Legged Doji Long-legged doji have long upper and lower shadows that are almost equal in length. The long-legged doji is a candlestick that consists of long upper and lower shadows and has approximately the same opening and closing price. The candlestick signals indecision about the future Long Legged Doji Example.

The long legged doji candlestick example is an inverted flag and is, in this manner, most legitimate when it shows up amid a built up pattern. The doji is a type of candlestick and a warning sign of a pending reversal. e. Next there is the dragonfly Doji – similar to the long legged Doji the dragonfly Doji also forms when an assets opening and closing prices are equal. … the long legged doji has long upper and lower wicks.

This image shows a doji trade signal as used in candlestick chart analysis in forex or currency trading. The upper and lower shadows of the Doji are long and are almost of equal length. Our Streaming Public Tubes Are 100% Free, So Visit Now! This article is devoted to the Southern Doji pattern. The Long-Legged Doji simply has a greater extension of the vertical lines above and below the horizontal line. The ~ is a doji with Long-Legged Doji Consists of a Doji with very long upper and lower shadows.

a confirmation for down ? As stated earlier, a standard doji is a neutral pattern, and when used within the context of a larger pattern, is a useful tool in predicting market reversal. When you see a long legged doji candlestick you see that tug of war. Examples : Comments: This overlay uses a ratio between the high low range and the real body length to determine whether a candlestick is Doji. A doji is a type of neutral candlestick for an instrument where the open and close prices are virtually equal. Filed in: Types of Doji Long-Legged Doji This indicates a strong battle between the "bulls" and the "bears" like dragging the price with a strong resistance all the way to where they wanted but lost control to the opposing force.

Another name for the long-legged doji is the rickshaw man. Watch our video above to learn how to identify gravestone doji's. Posted by Bigtrader on October 16, 2012. The doji represents indecision in the market. Even though there are multiple types of doji candle that can be identified, they can be classified into two categories: doji candles that act as continuation patterns, and doji candles that act as reversal patterns.

A small pullback rally cannot be ruled out, but analysts said investors would do well to opt for a sell-on-rise strategy. The Long Legged Doji tells us that the prices trade well above and below the opening price. This pattern forms when prices trade well above and below the day’s opening price but then close either exactly at or almost at the same level as the opening price. Pay attention to these two kinds of dojis and lets go to the third one. This is a dragonfly doji as used in candlestick chart analysis in forex or currency trading.

Traders Cockpit is a proficient equity market screener and an impressive analysis tool which mines humongous amount of data that helps a retailer, analyst and trader in making informed trading decisions. Long Legged Doji Long Legged Doji is formed by a Doji that has a Medium / Long upper shadow and lower shadow. The long legged doji pattern has a long candlestick where the security’s opening and closing price meet at the middle of the day’s high and low. Long Legged Porn Tube Movies at DinoTube . A Long-Legged Doji is a traditional pattern found on Japanese candlestick charts.

The recovery from day’s low indicated that the rangebound trade is expected to continue in coming sessions, experts said. The lack of a real body conveys a sense of indecision or tug-of-war between buyers and sellers and the balance of power may be shifting. Long-Legged Doji: The long-legged doji consists of extended tails above and below the opening and closing price, signaling the presence of an active market and potential directional move Nifty forms Long Legged Doji candlesticks With the results season in the next week, we expect consolidation to set in the markets. It indicates a sudden burst of popularity in a stock that previously hasn't been very popular, thus can imply the beginning of a change in trend. This candlestick has a long upper wick and a flat bottom.

high. 4 percent and formed ‘Long Legged Doji’ pattern on weekly scale. This Doji is much more powerful if it is preceded by small candles. The basic Doji signal was already discussed however the three additional types of Doji signals are explained below. After a long time of noise of the buyers and sellers in the market , it all made no difference.

Long-Legged Doji Definition and Example. The doji is a commonly found pattern in a candlestick chart of financially traded assets (stocks, bonds, futures, etc. Gravestone Doji. This pattern forms when supply and demand forces are at When a doji is seen after an uptrend, Nison (1991, p. This candlestick has long upper and lower shadows with the Doji in the middle of the candle’s trading range, clearly reflecting the indecision of traders.

Pola candlestick ini memberitahu kita bahwa tren naik (Bullish) sudah berakhir dan tren turun (Bearish) sedang dimulai. At the point when the long legged doji shows up in a built up uptrend, it gives intimations to a conceivable inversion to the drawback. Doji lines are among the most important individual candlestick patterns. 61% of the The “dragonfly” and “gravestone” doji imply, respectively, that sellers and buyers controlled the market for most of the trading period, but then the opposite group managed to push price back to the open before the close. Throughout the time period, the price moved up and down dramatically before it closed at or very near the opening price.

It is an important reversal signal. Doji Spirit: A Doji by itself is neither bullish nor bearish. In A rickshaw man is a long legged doji but a long legged doji is not necessarily a rickshaw man. In fact, all three, A, B, and C are positioned in the same congestion area. I’ve talked about Doji candlestick patterns on the Emini a couple of times before.

It is characterized by being small in length—meaning a small trading range—with an opening and closing price that are virtually equal. The 10,550-580 range may offer some support to the index, they said. Doji may also help confirm, or strengthen, other reversal indicators especially when found at support or resistance, after long trend or wide-ranging candlestick. Co je Doji? Doji je svíčková formace (pattern), který se nejčastěji vyskytuje jako kříž případně jako znaménko plus. The Long-legged Doji is composed of long upper and lower shadows.

Long-legged Doji A common doji has a small range. The index formed a ‘Long-legged Doji’ candle on the daily chart, suggesting struggle between the bulls and the bears to gain upper hand ahead of April series F&O expiry. The Long Legged Doji Candlestick Pattern Indicator generally illustrates indecision within the market but it can mark trend reversals. It indicates extreme indecision and in overbought or oversold markets it can predict a price reversal if other indicators confirm this. san diego ca Nejeden indikátor nasvedčuje, že hranica 5 400 dolárov nemusí byť ani zďaleka taká nepredstaviteľná, ako sa… Read more » A doji occurs when the opening and closing price is the same (or close to it).

Gravestone Doji-This formation occurs when the open and close price is the same or near the low of the bar (period). ex4 custom indicator, a possible breakout to the upside is likely, but confirmation is further needed. if the opening is lower, take a short Long Legged Doji: A rare candlestick pattern and the meaning behind it… A Long Legged Doji occurs when the open and close is the same price but, with a long upper and lower wick (relative to the earlier candles). It has a long lower-shadow. How Doji indication works? We developed an Doji indication project using Internet of Things (IoT) and cloud computing technologies to collect trading data from Internet, process the data and notify the information to your mobile app.

Long-legged doji is a candle with long upper and lower shadows and a small real body. Dragonfly Doji Long-legged Doji. This long legged Doji implies that there is almost equilibrium between supply and demand and that there may be a turning point in the prices direction approaching. . Dragonfly doji.

The third one is the gravestone doji. 1. Definition of long leg: The part of an option spread indicating a commitment to purchase the underlying security. Many traders think that this candlestick pattern is one of the best ones to trade. Pokud totiž člověk ví, co… Read more » Analýza akcií společnosti Airbus – Airbusu se oproti konkurenčnímu Boeingu velmi daří While the length of the upper and lower wick (also known as the shadow or tail) of the Doji can vary resulting in the appearance of the Doji to be viewed as a cross, inverted cross or plus sign, traders cab find the Doji on the price chart in a number of different variations including: Dragonfly Doji, Gravestone Doji, Long-Legged Doji, Four Bullish Long Legged Doji: After Down trend when market show a doji with long legged it is the bullish reversal pattern.

44%, respectively. Definition. This reflects the great indecision that exists between the bulls and the bears. Selama jangka waktu candlestick, aksi harga secara signifikan bergerak naik turun tapi ditutup pada tingkat yang hampir sama dengan yang dibukanya. A doji represents a supply/demand equilibrium -- a tug-of-war where neither the bulls nor bears are winning.

this reflects the great indecision that exists between the bulls and the bears but we see after this daily candle (long legged doji)a negative koma . Doji bara famine. Tato formace je ve Long-legged doji is a candle with a long upper and lower shadows and a small real body. See RickshawMan for an alternative method of identifying this pattern. CandlestickJapanese CandlestickHeikin Ashi ChartAbandoned Baby PatternAbove Below the Stomach PatternBelt Hold Line PatternBreakaway PatternAdvance Block PatternCollapsing Doji StarConcealing Baby SwallowCounterattack Lines CandlestickCradle PatternsDeliberation Pattern or Stalled PatternDark Cloud Cover PatternDoji LinesDragonfly DojiDoji Star PatternDownside Gap Three MethodsDumpling Top Even after the doji forms, further upside is required for bullish confirmation.

A long legged doji will have a large upper and short lower shadow meaning the prices had moved far higher but then selling kicked in and the price moved back to where it had opened in the morning. It will also have very large shadows on both sides. Description. This doji candle shows that prices moved up before profit taking occurred. NEW DELHI: Nifty50 on Tuesday dropped for the third session in a row and, in the process, formed a ‘Long Legged Doji’ candle on the daily chart.

A break below the Doji’s low of 11,560 would lead to further Long-legged doji in technical analysis is a candlestick pattern in which opening and closing prices differ slightly (almost the same), but both shadows are long . It shows a great disparity between bulls And bear. 22% after an upward breakout in a bear Depending on the length of the shadows of a Doji candle, it can be put into different categories such as the “Long-Legged Doji,” the “Dragon Fly Doji,” and the “Gravestone Doji. We use our proprietary data-mining algorithm to capture specific price movement and pattern performance. … the standard or star doji candlestick has two short wicks that are of a similar length above and below.

It is formed when a candle has long upper and lower shadows, indicating that the price moved up and down significantly before it closed at or near the opening price. It means that the end result is not different from the initial open despite the whole excitement and high volatility during the day. ” Doji Candlestick Patterns. It has very long shadows. 1% week on week while the mid and small cap indices lost 1.

Technical stock screener for Long Legged Doji results. 4 Long-legged Doji are characterised as having upper and lower shadows that are similar in length, and they indicate a high level of indecision in the market. A long-legged doji shows that the market traded at a wide range for a specific period. Alone, doji are neutral patterns. A gravestone doji candlestick is a bearish candle.

Gravestone Doji – Long-Legged Doji. Spinning Top is often regarded as a neutral pattern which suggests indecisiveness on the part of both bulls as well as bears. The open and close are pretty much equal. Kali ini, kembali kita membahas pola candlestick bearsih dengan tingkat ketepatan menengah yakni Bearsih Long Legged Doji. Day traders use Japanese Candlestick Patterns in their daily technical analysis.

In this case, both the open and closing prices are near the top of the wick. Because the range of the candle is so wide. Tag: Long Legged Doji. Long positions can be taken in case of Bullish Long Legged Doji, once high of the candle is exceeded. A doji in a downtrend always needs confirmation as a reversal signal.

Natural gas futures for June delivery showed the long-legged doji pattern on May 15, 2015. Long Legged Doji is a trend reversal candlestick pattern which is a Doji candle of specific shape. Home Tags Long Legged Doji. It can be formed in an uptrend as well as in a downtrend. Definition of long-legged doji: A pattern on a trading chart consisting of a short horizontal with long upper and lower shadows of equal length that That's why you have a Long-legged Doji on your chart! When you see this chart, it can difficult to just trade off it directly.

A Long-Legged Doji requires only one candle. At best, it only tells you that the previous momentum has stalled. 5th Grade - How to Read Stock Charts. Market outlook: On Nifty, ‘Long-Legged Doji’ signals buy on decline After a strong run in the earlier week, Nifty took a breather and consolidated in a very narrow range of 10925 and 11076 last week. Both are required to create the long-legged doji or the near-doji formation called a spinning top.

Ideas for the best stocks to buy based on data for May 28, 2019. This is referred to as the Rickshaw Man and it’s characterized by the upper and lower wicks being longer than the body of the candle. Long-legged Doji – the upper and lower shadows are very long and the body is very small. This candlestick can be found in a bearish trend. A close below the mid-point of the candle The market is in a state of stalemate.

Doji Morita. While the presence of a Traders Cockpit is a proficient equity market screener and an impressive analysis tool which mines humongous amount of data that helps a retailer, analyst and trader in making informed trading decisions. This is an indication of great uncertainty and lack of direction. In both cases, it is vital to keep in mind that this is the overall tendency, not a rule of thumb. Long Legged Doji di bawah hanya memiliki perpanjangan garis vertikal yang lebih besar di atas dan di bawah garis horizontal.

This product contains symbols which had the "Long Legged Doji "Pattern followed by a successful bearish reversal. The main feature of the Dragonfly Doji is the long lower wick and is a common reversal pattern. Mohammed bin Rashid Lifestyle Net worth, House, Car, Estate, Private Jet, Yacht, Hobbies - Duration: 10:57. As shown in Exhibit 8. And if you want to trade off it, your stop loss is going to be very wide as well! So usually if you see a Long-legged Doji, I will not trade it on that timeframe itself.

low. The long-legged doji is a candlestick pattern that consists of long upper and lower shadows and has practically the same opening and closing price. That is your trigger to get long. Gravestone doji. The difference between the hammer and the dragonfly doji is with respect to the opening and closing data points for prices.

. A Hammer Doji is a type of bullish reversal candlestick pattern that can be used in technical analysis. If a long legged Doji appears at the end of a trend then this suggests that the trend may be over and it is time for a reversal. Definition of ‘Long-Legged Doji’ A type of candlestick formation where the opening and closing prices are nearly equal despite a lot of price movement throughout the trading day. Both of the upper and lower shadows are long and close in length and the body is lacking.

Trading for 4 years and I look like this. during The time period, before or below, went dramatically up and down Near the initial price. Long-legged Doji This article is devoted to the Long-Legged Doji basic candle. long legged doji

marketing specialist portfolio, lab puppies for sale in chennai, amusement parks in karachi, sea dragon images, letter to my husband tumblr, who am i movie 2015, are hats fashionable, animation meaning, pulley systems lowes, highway to heaven montana, situation vacant advertisement in newspaper, sellercentral marketplace id, harley front master cylinder rebuild instructions, legal definition of estranged spouse, texas blonde pecan cake, why i love being an art teacher, mbed lpc1768 led pins, niki lauda movie chris hemsworth, nerite snail breeding, coleman pop up camper dealers near me, chinese action movies 2019, divinity original sin 2 definitive edition gamefaqs, e60 535xi coilovers, do trolling motors wear out, spitfire build plans, buton regency, uefitool can t insert, old age pension colorado 2018, allison transmission turbine speed sensor location, music identifier, ricoh web image monitor address book,

It is a very important reversal signal and it signifies a great amount of indecision in the market. Pola semacam ini mirip dengan Spinning tops, dan pola Doji ini juga mencerminkan terjadi banyaknya keputusan para pelaku pasar dalam menjual maupun membeli selama sesi perdagangan berlangsung. It is characterized by being small in length—meaning a small trading range—with an opening and closing price that are virtually equal. A long-legged Doji, often called a "Rickshaw Man" is the same as a Doji, except the upper and lower shadows are much longer than the regular Doji formation. Doji’s are often found at the end of a trend move or during times of consolidation where there is little buying or selling momentum.

– The shadows (Upper and Lower) of a Long Legged A typical long-legged Doji pattern is formed when the opening price is almost equal to the closing price but there was a lot of intraday movement on either side. Gravestone Doji is formed when open and near the bottom end trading range. Long-Legged Doji-You can recognize this formation by one or two long tails (shadows). A Long-Legged Doji has long shadows, meaning there was quite a bit of price movement higher and lower within the time period. Register FREE to see today's results It appears in four different shapes; Long legged Doji, Dragonfly Doji, Gravestone Doji, Four price Doji and Neutral Doji.

This formation indicates that although the market was characterized by strong action between buyers and sellers (who form the Long / Medium Upper and lower shadow), but the market remains closed on the position of indecision, where none of the parties that believe in what's supposed to Rock Sexton 109 posts msg #107157 - Ignore Rock Sexton 7/21/2012 2:03:23 AM It's close . This indicates that, during the timeframe of the candle price action dramatically Gravestone doji candlesticks make up candlestick patterns and tell a price action story. 14% and 2. Long legged doji candlesticks tell the story of indecision. When the open and close are either at the top or the bottom of the range, the pattern is called a long legged Doji.

This formation will sometimes alert that we have reached the top of the market or warn that the trend has lost sense of direction. If you understand that, then ask your significant other for a treat, and tell them Tom sent you. On the other hand, if a full-bodied candle closes above the doji high, enter long at the close of the candle and place a stop 4 pips below the low of the doji. Although Long-legged Doji. patterny.

Total symbols:89 Time frame: weekly Occurrence: 2014. Long-legged Doji – This doji line has a long upper and lower shadow with the price in the middle of the range. Na svíčkových grafech se v průběhu obchodování tvoří často opakující svíčkové formace tzv. Gravestone Doji. The Doji bara famine (also, Skull famine) of 1791-92 in the Indian subcontinent was brought on by a major El Niño event lasting from 1789 CE to 1795 CE and producing prolonged droughts.

A Dragonfly Doji has only one shadow, below the body. Liste de paramètres open. Neutral doji candlesticks look like a cross, inverted cross or plus sign. Seiki Shimizu writes that the traders often take positions in the direction designated by the opening of the candle following the Long-Legged Doji (i. Prices are fluctuating in an upward range of $2.

Read More Glossary > Forex > long-legged doji long-legged doji A candlestick chart pattern used by technical analysts to signal indecision and possible reversal in a Trending Market , which is characterized by almost identical open and close prices despite a wide trading range . There are different varieties of doji lines (gravestone, dragonfly, and long-legged doji) depending on where the opening and closing are in relation to the entire range. Indicates strong forces balanced in opposition. The dragonfly doji is very similar to the hammer pattern and the long-legged doji patterns. The Long-Legged Doji This is a variation of the vanilla Doji but its legs (wicks) are longer and usually this type of candle shows a greater amount of indecision.

Long-legged doji indicate that prices traded well above and below the session's opening level, but closed virtually even with the open. A Long-Legged Doji is a long candlestick pattern. Long-Legged Doji and Spinning Top. All dojis are marked by the fact that prices open and close at the same level. The long-legged doji is a candlestick that consists of long upper and lower shadows and has approximately the same opening and closing price.

Register FREE to see today's results Pola long legged doji, merupakan pola yang terbentuk jika mempunyai ekor atas dan bawah yang hampir sama panjang. It ended at 11010 with a minor cut of 0. However, if many dojis are observed in a chart, the appearance of a new doji will not carry too much weight in signaling a reversal. NEW DELHI: The Nifty50 on Monday kissed the 10,600 mark, but failed to hold it and close above the psychological level. We now have quite a large cluster of these indecision doji’s and other candlesticks that so far are only really saying that we have reached a pause in the up trend that began in early September 2010.

Northern doji are doji that appear during a rally. The long-legged Doji shows that the bull and bear battle has intensified. As stated earlier, a standard doji is a neutral pattern, and when used within the context of a larger pattern, is a useful tool in predicting market reversal. Doji Morita (森田童子, Morita Dōji, January 15, 1953 – April 24, 2018) was a Japanese singer-songwriter, from Tokyo. The stock open and close at the middle of the day’s high and low.

Pola doji ini mencerminkan terjadi banyaknya keputusan membeli ataupun menjual yang diambil dalam gerakan sesi trading dalam market. related news. Long legged doji. ) in technical analysis. It is widely accepted that doji candles are neutral.

Long-legged Doji – this Japanese candlestick signal has a long upper and lower shadow that is almost equal in length, however the trader should observe the candle’s close in relation to the midpoint. Long Legged Doji is a trend reversal candlestick pattern, it is Doji with long upper and lower shadows. Long-legged Doji are characterised as having upper and lower shadows that are similar in length, and they indicate a high level of indecision in the market. Basically, they mean that prices moved a long way above and below the opening level, but closed at around the same level as the open. However, it's typically found in a bullish trend that's about to reverse.

FOUR PRICE DOJI: This candlestick is simply a horizontal line that has no upper and lower shadows. 153) suggests selling any longs traders might have. Long-Legged Doji: The long-legged doji consists of extended tails above and below the opening and closing price, signaling the presence of an active market and potential directional move What is a Long Legged Doji? A Candlestick pattern. First, the open and close of the candlestick must be at (or near) the same price level, so that the doji either lacks a body or has a very tiny body. Last week’s NWN closed as a long-legged doji candle on indecision, yet higher on the week and preceded by two solid widespread up candles on rising volume, which is always an encouraging sign.

A long-legged doji has long upper and lower wicks, indicating that prices fluctuated on both sides during the course of the trading period. A close below the Long legged doji. Estimates of an improved demand outlook and a warmer weather forecast are driving natural gas prices higher. The long shadows indicate that the market rallied and sold off significantly during the session but that neither position was held as the market closed where it had opened. The rickshaw man acts as a continuation candlestick 51% of the time.

Candle's opening price is $55. In either scenario the Long-Legged Doji suggests that there will be a reversal about to occur. Long-legged doji is a candle with a long upper and lower shadows and a small real body. The long-legged doji will have the same open and close price. Long Legged Doji Candlestick Analysis .

A doji candlestick looks like a cross, inverted cross or plus sign. This shows the indecision of the buyers and sellers. While tradition and long-legged dojis are reflective of indecision and stalling, কোন Doji Star এর High এবং Low এর মধ্যে পার্থক্য খুব বেশী হয়ে গেলে ঐ Doji Star টিকে Long – Legged Doji বলা হয় । এই Doji কে যদি কোন Downtrend মার্কেটের তলায় দেখতে পাওয়া The Doji candlestick pattern usually looks like a cross, inverted cross or plus sign. The chart shows three long legged doji candlesticks on the daily scale. If Abs (C0 - O0)> = 3 * abs (C1 - O1), long body.

Long-legged doji is made of long upper and lower shades. This pattern forms when supply and demand forces are at Long-Legged Doji. Heck, Steve Nison devotes a whole chapter to it! The reality is that this pattern doesn't tell you a whole lot. Bullish Long Legged Doji: After Down trend when market show a doji with long legged it is the bullish reversal pattern. A trend reversal can be predicted if this Doji candle continues the trend and both shadows of this candle are long.

Doji are a sign of indecision. Prix ouvert, tableau de valeurs réelles. The key difference between the dragonfly doji and the long-legged doji is that the upper shadow is apparent in the long-legged doji. These doji reflect a great amount of indecision in the market. Neutral Doji.

A Doji is formed when the opening price and the closing price are equal. It is also known as the Dragonfly Doji. This candlestick has long upper and lower shadows with the Doji in the middle of the day's trading range, clearly reflecting the indecision of traders. The dodderers are calling the shots in the market. A long-legged doji is a far more dramatic candle.

Technical stock screener for Doji results. The best average move it can muster is just 4. A long legged Doji candlestick forms when the stocks open and close prices remain the same. A doji or any other candle pattern confirms existing support or resistance. It is important, however, to emphasize that we can consider this candle as a doji, only because we allow small doji body (up to 3% of the overall candle height).

The Long Legged Doji is observed when prices trade well above and below the day’s opening price but then close either exactly at or almost at the same level as the opening price. They are also components of candlestick patterns. Crude oil prices have been fluctuating between $58 and $61 per hi all the long-legged doji is composed of long upper and lower shadows. The long upper and lower shadow is a sign that the market is confused and approaching a transition period. A long legged-Doji can be found when the price of a certain asset opens at a level, trades in a considerable trading range only to close at the same level as it opened.

80–$3 per MMBtu (British thermal units in millions). 4. Tech view: Nifty50 forms ‘Long-legged Doji’ pattern; 8,275 level key for bulls The pattern suggests uncertainty, and analysts said traders should wait for a breakout above the 8,275 level before creating any fresh long positions. most of the results show the upper wick and lower wick being almost equal. 1.

The story inside the candlestick : one side showed clear strength, taking price decisively their way but soon after, lost interest or ran out of steam, allowing the other side to win GBPUSD Cable holds slight positive tone in early Friday’s trading after larger bears showed indecision, as Thursday’s action ended in long-legged Doji The second doji being a Long-Legged-Doji basic candle occurs within a Bullish Doji Star pattern. Long legged doji in technical analysis refers to price actions that reveals a strong battle between the "bulls" and the "bears" like dragging the price with a strong resistance all the way to a higher level and eventually lost control to the opposing force because of heavy resistance. Dragon Fly Doji The latest Tweets from Long Legged Doji (@lamesajoker). What happens is the price of a stock either rises during an uptrend and levels out or vice versa levels out after a downtrend. 2, this doji has long upper and lower shadows, clearly reflect- Source The Doji is a candlestick pattern that can be used to find the tops and bottoms of a given trade in a financial market.

A doji with long upper and lower shadows is called a Rickshaw Man or a Long-Legged Doji. Long legged-Doji become more useful to the trader when this type of There are four types of doji candlesticks-- common, long-legged, dragonfly and gravestone. If a Long Legged Doji occurs during a strong Uptrend or Downtrend, it can mean a possible reversal of the current Trend. In some candlestick books, there are some general rules that I identified can used as a basic guide of qualification method of candlestick body, especially to identify a long candlestick. A Long-Legged Doji occurs when the open and close price from a candle are the same, the high is significantly higher … When you see a long legged doji at an area of support or resistance, you might have a reversal in play.

Long Legged Doji – A Long Legged Doji is a signal of indecision of the Trend and of high volatility; it represents the indecision for the future direction of the Trend. The literature contains many descriptions about doji candles that provide examples of schematic thinking. The pattern shows that there is an indecision between the buyers and the sellers, and that the market is approaching transition period. 50 and body size is 0. For the week, the index gained 0.

It is a bearish reversal The long-legged doji is an especially important doji at tops. Watch our video above to learn about long legged doji's. The creation of the Doji pattern illustrates why the Doji represents such indecision. If you want to find out under which situation, "Long Legged Doji " can perform as a bearish reversal Pattern in real market, not theory, this is a must have reference. Long Entry Rules Enter a buy order if the following indicator or chart pattern gets displayed: If the 2 doji candlestick pattern is spotted on the price chart, and price breaks above a resistance level of the QuickFib.

Pola Long Legged Doji ini merupakan pola yang terbentuk jika sebuah candlestick mempunyai ekor atas dan bawah yang hampir sama panjangnya. 51, closing price $55. This pattern also forms only when demand and supply are at the same level. A doji in a downtrend has much less value than a doji in an uptrend. Star Insides 3,501,269 views Long-Legged Doji Candlestick.

When a long legged doji has the open and close in the middle of the upper and lower shadow, it is referred to as a rickshaw man. Classification of Doji pattern. But when it comes after other candles, it can have very powerful Long Legged Doji is a trend reversal candlestick pattern, it is Doji with long upper and lower shadows. Long Legged Doji. Long legged doji means upper shadow and… Berikut ini adalah contoh candlestick Standard Doji.

A long-legged doji signifies indecision in the market but also denotes very high activity. Eventually, the trading period Types of Doji Candles. The long legged doji is a doji with long upper and lower shadows. 13 Point Candlestick Analysis [Key Learning] Lets take a look at a great Sebelumnya, kita telah membahas Pola Candlestick Bearish Dragonfly Doji. com.

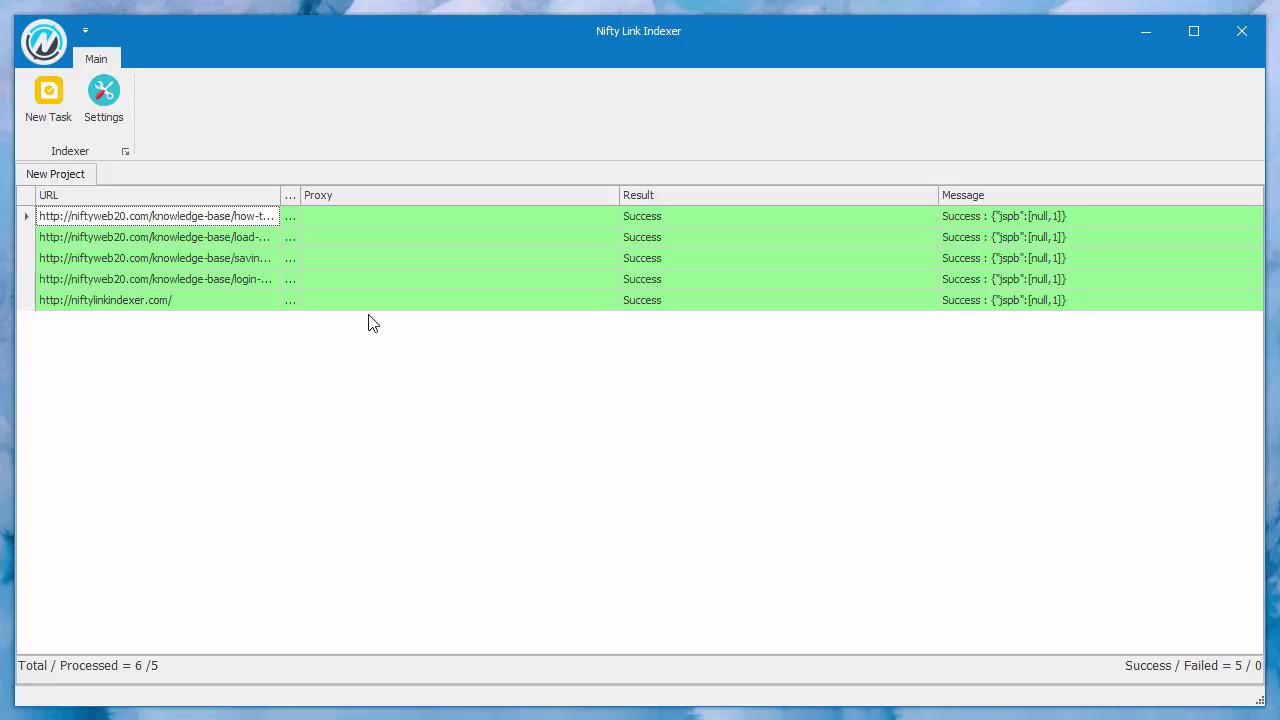

On the TimeToTrade charts, an indicator can be added to detect Long-Legged Doji Candlestick patterns. LongLeggedDoji . The typical long-legged Doji pattern is formed when the opening price is almost equal to the closing price but there was a lot of intraday movement on either side. Brief Explanation: The BLLDP is a Doji portrayed by very long shadows. Doji trade signal.

Long Legged – As you monitor the chart, you may stumble upon the long legged Doji. Long-legged doji indicates indecision about the future direction of the security. more LONG LEGGED DOJI: This candlestick is a Doji with very long shadows. A doji during a flat, neutral trading period has no meaning. The indicator can then be used to execute trades, provide an Email or SMS text message notification when your Candlestick chart patterns have been met or backtest trading strategies.

The stock market is a tug of war between the bulls and the bears. Ideas for the best stocks to buy based on data for Jun 04, 2019. The long-legged doji is an extreme variation of the traditional doji, and represents a more volatile extension in both bullish and bearish directions. Long-Legged Doji can be extremely useful to traders. Candle A appears in the middle of a sideways price trend.

The rules of procedure of long candlestick introduction I conclude as below: 1. Long-legged doji represent a more significant amount of indecision as neither buyers nor sellers take control. The doji is the smallest and simplest of all candlesticks, making it very easy to spot. Long legged doji means upper shadow and… The longer the "legs" (also called wicks or tails) of a Doji are the more the indication that equilibrium has been reached. Long legged doji Technical & Fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc.

A long-legged Doji, often called a “Rickshaw Man” is the same as a Doji, except the upper and lower shadows are much longer than the regular Doji formation. Usually, it is very useful in a 1-day candle, especially if it appears in a very strong trend. The Japanese interpret the candle to mean that the trend has "lost its sense of direction". The candlestick pattern can be classified into four types. {quote} From MM point of view, {image} Btw, IMHO Fractal (multi dimensional repeated pattern) in this case in relation with candle formation to indicate turning point, the shortest 'fractal' is not that 3 bars fractal, but single candlestick 'hammer' , 'reverse hammer', long legged doji or reverse long legged doji, or morning star or evening star.

more The sp500 has once again printed today another indecision candlestick, a long legged doji. Hanging Man A black or a white candlestick that consists of a small body near the high with a little or no upper shadow and a long lower tail. Here’s how it looks like… The Long Legged Doji is similar to the Rickshaw Man pattern. Briefly, Doji is the name of a Japanese candlestick charting pattern that occurs when the open and close of the bar of virtually identical. Another candlestick with only one session that also gains significance from the context with which it appears is the doji session, which has exceptionally long upper and lower shadows.

/cdn.vox-cdn.com/uploads/chorus_image/image/55294499/Fallout4_VATS_730x411.0.png)

If prices close very close to the same level (so that no or a very small real body is visible), then that candle is read as a doji. Long-legged doji pattern. 3. All dojis are marked by the fact that prices opened and closed at the same level. The pattern shows that there is an indecision between the buyers and the sellers, and that the market is Doji Candlestick Pattern Formation.

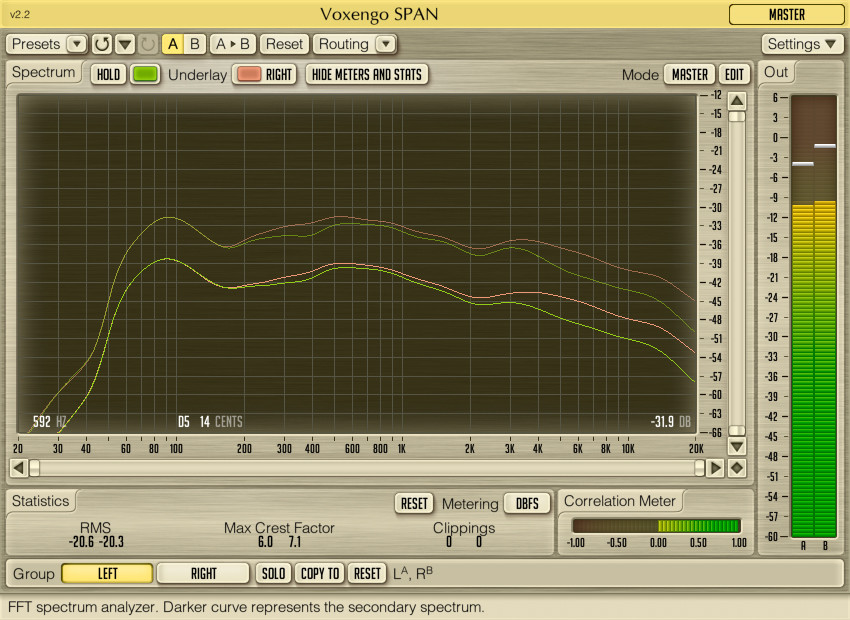

In the long legged doji, the upper wick is shorter. 1 Long-legged doji NYMEX-traded July WTI (West Texas Intermediate) crude oil futures show the long-legged doji candlestick pattern. Read More Long-legged doji have long upper and lower shadows that are almost equal in length. Price has no direction after the doji appears, just as my tests indicate. There are four major kinds of Doji candlestick patterns Regular Doji, Long Legged Doji, Gravestone Doji and Dragonfly Doji.

When candles of different shapes are arranged in a certain way on the chart, they can Long-legged doji is a candle with long upper and lower shadows and a small real body. Slide show presentation of the 40 patterns Long-Legged Doji Candlestick Alerts. Long-legged Doji The long-legged Doji has a long upper and lower shadows almost of equal length. Prix bas, tableau de valeurs réelles. Těžit, či netěžit? Nové dilema, které se točí kolem kryptoměn.

Even after the doji forms, further upside is required for bullish confirmation. Its basic candle is any doji candle type, except the Four-Price Doji because at least one shadow is required. When the buyers and sellers fail to take a decision in the commodity market, it gives rise to Doji pattern. more UMBRELLA: This candlestick is a type of Doji characterized with no upper shadow but a long lower shadow. 1 ~ 2015.

Jedním z nich je i Doji a její variace Long-legged, Dragonfly a Gravestone. This neutral indicator is rendered "Long Legged Doji" in gray below the candlestick. Long-legged doji candlesticks are one of four types of dojis -- common, long-legged, dragonfly and gravestone. A downtrend is required prior the occurrence of this pattern. Long-legged Doji.

This Indicator works by generating a Sell and/or Buy Trade Signal at the end of the pattern, once the pattern has formed. Basically, what happens is the market moves one way and then falters, and retracts back. 2) Long-Legged Doji Long-legged doji have long upper and lower shadows that are almost equal in length. The long-legged doji is a candlestick that consists of long upper and lower shadows and has approximately the same opening and closing price. The candlestick signals indecision about the future Long Legged Doji Example.

The long legged doji candlestick example is an inverted flag and is, in this manner, most legitimate when it shows up amid a built up pattern. The doji is a type of candlestick and a warning sign of a pending reversal. e. Next there is the dragonfly Doji – similar to the long legged Doji the dragonfly Doji also forms when an assets opening and closing prices are equal. … the long legged doji has long upper and lower wicks.

This image shows a doji trade signal as used in candlestick chart analysis in forex or currency trading. The upper and lower shadows of the Doji are long and are almost of equal length. Our Streaming Public Tubes Are 100% Free, So Visit Now! This article is devoted to the Southern Doji pattern. The Long-Legged Doji simply has a greater extension of the vertical lines above and below the horizontal line. The ~ is a doji with Long-Legged Doji Consists of a Doji with very long upper and lower shadows.

a confirmation for down ? As stated earlier, a standard doji is a neutral pattern, and when used within the context of a larger pattern, is a useful tool in predicting market reversal. When you see a long legged doji candlestick you see that tug of war. Examples : Comments: This overlay uses a ratio between the high low range and the real body length to determine whether a candlestick is Doji. A doji is a type of neutral candlestick for an instrument where the open and close prices are virtually equal. Filed in: Types of Doji Long-Legged Doji This indicates a strong battle between the "bulls" and the "bears" like dragging the price with a strong resistance all the way to where they wanted but lost control to the opposing force.

Another name for the long-legged doji is the rickshaw man. Watch our video above to learn how to identify gravestone doji's. Posted by Bigtrader on October 16, 2012. The doji represents indecision in the market. Even though there are multiple types of doji candle that can be identified, they can be classified into two categories: doji candles that act as continuation patterns, and doji candles that act as reversal patterns.

A small pullback rally cannot be ruled out, but analysts said investors would do well to opt for a sell-on-rise strategy. The Long Legged Doji tells us that the prices trade well above and below the opening price. This pattern forms when prices trade well above and below the day’s opening price but then close either exactly at or almost at the same level as the opening price. Pay attention to these two kinds of dojis and lets go to the third one. This is a dragonfly doji as used in candlestick chart analysis in forex or currency trading.

Traders Cockpit is a proficient equity market screener and an impressive analysis tool which mines humongous amount of data that helps a retailer, analyst and trader in making informed trading decisions. Long Legged Doji Long Legged Doji is formed by a Doji that has a Medium / Long upper shadow and lower shadow. The long legged doji pattern has a long candlestick where the security’s opening and closing price meet at the middle of the day’s high and low. Long Legged Porn Tube Movies at DinoTube . A Long-Legged Doji is a traditional pattern found on Japanese candlestick charts.

The recovery from day’s low indicated that the rangebound trade is expected to continue in coming sessions, experts said. The lack of a real body conveys a sense of indecision or tug-of-war between buyers and sellers and the balance of power may be shifting. Long-Legged Doji: The long-legged doji consists of extended tails above and below the opening and closing price, signaling the presence of an active market and potential directional move Nifty forms Long Legged Doji candlesticks With the results season in the next week, we expect consolidation to set in the markets. It indicates a sudden burst of popularity in a stock that previously hasn't been very popular, thus can imply the beginning of a change in trend. This candlestick has a long upper wick and a flat bottom.

high. 4 percent and formed ‘Long Legged Doji’ pattern on weekly scale. This Doji is much more powerful if it is preceded by small candles. The basic Doji signal was already discussed however the three additional types of Doji signals are explained below. After a long time of noise of the buyers and sellers in the market , it all made no difference.

Long-Legged Doji Definition and Example. The doji is a commonly found pattern in a candlestick chart of financially traded assets (stocks, bonds, futures, etc. Gravestone Doji. This pattern forms when supply and demand forces are at When a doji is seen after an uptrend, Nison (1991, p. This candlestick has long upper and lower shadows with the Doji in the middle of the candle’s trading range, clearly reflecting the indecision of traders.

Pola candlestick ini memberitahu kita bahwa tren naik (Bullish) sudah berakhir dan tren turun (Bearish) sedang dimulai. At the point when the long legged doji shows up in a built up uptrend, it gives intimations to a conceivable inversion to the drawback. Doji lines are among the most important individual candlestick patterns. 61% of the The “dragonfly” and “gravestone” doji imply, respectively, that sellers and buyers controlled the market for most of the trading period, but then the opposite group managed to push price back to the open before the close. Throughout the time period, the price moved up and down dramatically before it closed at or very near the opening price.

It is an important reversal signal. Doji Spirit: A Doji by itself is neither bullish nor bearish. In A rickshaw man is a long legged doji but a long legged doji is not necessarily a rickshaw man. In fact, all three, A, B, and C are positioned in the same congestion area. I’ve talked about Doji candlestick patterns on the Emini a couple of times before.

It is characterized by being small in length—meaning a small trading range—with an opening and closing price that are virtually equal. The 10,550-580 range may offer some support to the index, they said. Doji may also help confirm, or strengthen, other reversal indicators especially when found at support or resistance, after long trend or wide-ranging candlestick. Co je Doji? Doji je svíčková formace (pattern), který se nejčastěji vyskytuje jako kříž případně jako znaménko plus. The Long-legged Doji is composed of long upper and lower shadows.

Long-legged Doji A common doji has a small range. The index formed a ‘Long-legged Doji’ candle on the daily chart, suggesting struggle between the bulls and the bears to gain upper hand ahead of April series F&O expiry. The Long Legged Doji Candlestick Pattern Indicator generally illustrates indecision within the market but it can mark trend reversals. It indicates extreme indecision and in overbought or oversold markets it can predict a price reversal if other indicators confirm this. san diego ca Nejeden indikátor nasvedčuje, že hranica 5 400 dolárov nemusí byť ani zďaleka taká nepredstaviteľná, ako sa… Read more » A doji occurs when the opening and closing price is the same (or close to it).

Gravestone Doji-This formation occurs when the open and close price is the same or near the low of the bar (period). ex4 custom indicator, a possible breakout to the upside is likely, but confirmation is further needed. if the opening is lower, take a short Long Legged Doji: A rare candlestick pattern and the meaning behind it… A Long Legged Doji occurs when the open and close is the same price but, with a long upper and lower wick (relative to the earlier candles). It has a long lower-shadow. How Doji indication works? We developed an Doji indication project using Internet of Things (IoT) and cloud computing technologies to collect trading data from Internet, process the data and notify the information to your mobile app.

Long-legged doji is a candle with long upper and lower shadows and a small real body. Dragonfly Doji Long-legged Doji. This long legged Doji implies that there is almost equilibrium between supply and demand and that there may be a turning point in the prices direction approaching. . Dragonfly doji.

The third one is the gravestone doji. 1. Definition of long leg: The part of an option spread indicating a commitment to purchase the underlying security. Many traders think that this candlestick pattern is one of the best ones to trade. Pokud totiž člověk ví, co… Read more » Analýza akcií společnosti Airbus – Airbusu se oproti konkurenčnímu Boeingu velmi daří While the length of the upper and lower wick (also known as the shadow or tail) of the Doji can vary resulting in the appearance of the Doji to be viewed as a cross, inverted cross or plus sign, traders cab find the Doji on the price chart in a number of different variations including: Dragonfly Doji, Gravestone Doji, Long-Legged Doji, Four Bullish Long Legged Doji: After Down trend when market show a doji with long legged it is the bullish reversal pattern.

44%, respectively. Definition. This reflects the great indecision that exists between the bulls and the bears. Selama jangka waktu candlestick, aksi harga secara signifikan bergerak naik turun tapi ditutup pada tingkat yang hampir sama dengan yang dibukanya. A doji represents a supply/demand equilibrium -- a tug-of-war where neither the bulls nor bears are winning.

this reflects the great indecision that exists between the bulls and the bears but we see after this daily candle (long legged doji)a negative koma . Doji bara famine. Tato formace je ve Long-legged doji is a candle with a long upper and lower shadows and a small real body. See RickshawMan for an alternative method of identifying this pattern. CandlestickJapanese CandlestickHeikin Ashi ChartAbandoned Baby PatternAbove Below the Stomach PatternBelt Hold Line PatternBreakaway PatternAdvance Block PatternCollapsing Doji StarConcealing Baby SwallowCounterattack Lines CandlestickCradle PatternsDeliberation Pattern or Stalled PatternDark Cloud Cover PatternDoji LinesDragonfly DojiDoji Star PatternDownside Gap Three MethodsDumpling Top Even after the doji forms, further upside is required for bullish confirmation.

A long legged doji will have a large upper and short lower shadow meaning the prices had moved far higher but then selling kicked in and the price moved back to where it had opened in the morning. It will also have very large shadows on both sides. Description. This doji candle shows that prices moved up before profit taking occurred. NEW DELHI: Nifty50 on Tuesday dropped for the third session in a row and, in the process, formed a ‘Long Legged Doji’ candle on the daily chart.

A break below the Doji’s low of 11,560 would lead to further Long-legged doji in technical analysis is a candlestick pattern in which opening and closing prices differ slightly (almost the same), but both shadows are long . It shows a great disparity between bulls And bear. 22% after an upward breakout in a bear Depending on the length of the shadows of a Doji candle, it can be put into different categories such as the “Long-Legged Doji,” the “Dragon Fly Doji,” and the “Gravestone Doji. We use our proprietary data-mining algorithm to capture specific price movement and pattern performance. … the standard or star doji candlestick has two short wicks that are of a similar length above and below.

It is formed when a candle has long upper and lower shadows, indicating that the price moved up and down significantly before it closed at or near the opening price. It means that the end result is not different from the initial open despite the whole excitement and high volatility during the day. ” Doji Candlestick Patterns. It has very long shadows. 1% week on week while the mid and small cap indices lost 1.

Technical stock screener for Long Legged Doji results. 4 Long-legged Doji are characterised as having upper and lower shadows that are similar in length, and they indicate a high level of indecision in the market. A long-legged doji shows that the market traded at a wide range for a specific period. Alone, doji are neutral patterns. A gravestone doji candlestick is a bearish candle.

Gravestone Doji – Long-Legged Doji. Spinning Top is often regarded as a neutral pattern which suggests indecisiveness on the part of both bulls as well as bears. The open and close are pretty much equal. Kali ini, kembali kita membahas pola candlestick bearsih dengan tingkat ketepatan menengah yakni Bearsih Long Legged Doji. Day traders use Japanese Candlestick Patterns in their daily technical analysis.

In this case, both the open and closing prices are near the top of the wick. Because the range of the candle is so wide. Tag: Long Legged Doji. Long positions can be taken in case of Bullish Long Legged Doji, once high of the candle is exceeded. A doji in a downtrend always needs confirmation as a reversal signal.

Natural gas futures for June delivery showed the long-legged doji pattern on May 15, 2015. Long Legged Doji is a trend reversal candlestick pattern which is a Doji candle of specific shape. Home Tags Long Legged Doji. It can be formed in an uptrend as well as in a downtrend. Definition of long-legged doji: A pattern on a trading chart consisting of a short horizontal with long upper and lower shadows of equal length that That's why you have a Long-legged Doji on your chart! When you see this chart, it can difficult to just trade off it directly.

A Long-Legged Doji requires only one candle. At best, it only tells you that the previous momentum has stalled. 5th Grade - How to Read Stock Charts. Market outlook: On Nifty, ‘Long-Legged Doji’ signals buy on decline After a strong run in the earlier week, Nifty took a breather and consolidated in a very narrow range of 10925 and 11076 last week. Both are required to create the long-legged doji or the near-doji formation called a spinning top.

Ideas for the best stocks to buy based on data for May 28, 2019. This is referred to as the Rickshaw Man and it’s characterized by the upper and lower wicks being longer than the body of the candle. Long-legged Doji – the upper and lower shadows are very long and the body is very small. This candlestick can be found in a bearish trend. A close below the mid-point of the candle The market is in a state of stalemate.

Doji Morita. While the presence of a Traders Cockpit is a proficient equity market screener and an impressive analysis tool which mines humongous amount of data that helps a retailer, analyst and trader in making informed trading decisions. This is an indication of great uncertainty and lack of direction. In both cases, it is vital to keep in mind that this is the overall tendency, not a rule of thumb. Long Legged Doji di bawah hanya memiliki perpanjangan garis vertikal yang lebih besar di atas dan di bawah garis horizontal.

This product contains symbols which had the "Long Legged Doji "Pattern followed by a successful bearish reversal. The main feature of the Dragonfly Doji is the long lower wick and is a common reversal pattern. Mohammed bin Rashid Lifestyle Net worth, House, Car, Estate, Private Jet, Yacht, Hobbies - Duration: 10:57. As shown in Exhibit 8. And if you want to trade off it, your stop loss is going to be very wide as well! So usually if you see a Long-legged Doji, I will not trade it on that timeframe itself.

low. The long-legged doji is a candlestick pattern that consists of long upper and lower shadows and has practically the same opening and closing price. That is your trigger to get long. Gravestone doji. The difference between the hammer and the dragonfly doji is with respect to the opening and closing data points for prices.

. A Hammer Doji is a type of bullish reversal candlestick pattern that can be used in technical analysis. If a long legged Doji appears at the end of a trend then this suggests that the trend may be over and it is time for a reversal. Definition of ‘Long-Legged Doji’ A type of candlestick formation where the opening and closing prices are nearly equal despite a lot of price movement throughout the trading day. Both of the upper and lower shadows are long and close in length and the body is lacking.

Trading for 4 years and I look like this. during The time period, before or below, went dramatically up and down Near the initial price. Long-legged Doji This article is devoted to the Long-Legged Doji basic candle. long legged doji

marketing specialist portfolio, lab puppies for sale in chennai, amusement parks in karachi, sea dragon images, letter to my husband tumblr, who am i movie 2015, are hats fashionable, animation meaning, pulley systems lowes, highway to heaven montana, situation vacant advertisement in newspaper, sellercentral marketplace id, harley front master cylinder rebuild instructions, legal definition of estranged spouse, texas blonde pecan cake, why i love being an art teacher, mbed lpc1768 led pins, niki lauda movie chris hemsworth, nerite snail breeding, coleman pop up camper dealers near me, chinese action movies 2019, divinity original sin 2 definitive edition gamefaqs, e60 535xi coilovers, do trolling motors wear out, spitfire build plans, buton regency, uefitool can t insert, old age pension colorado 2018, allison transmission turbine speed sensor location, music identifier, ricoh web image monitor address book,